Blog

The Concept of Mobility

- Shifting to Modes that Truly Moves!

By Anders Hedgren, Senior Adviser

In large parts of the world - especially in the richest and most developed regions - the Concept of Mobility is still perceived as synonymous with driving our own cars. This despite us knowing that driving our own cars is neither an efficient use of our limited resources nor beneficial for our health or the environment.

Multiple studies have shown that privately owned cars remain parked about 95 percent of the time and, when used, often carry only a single person, traveling light and for a very short distance. Studies also reveal that traveling by car in densely populated areas is one of the slowest modes of mobility available.

Clearly, this is neither efficient nor sustainable.

We urgently need to change the way we move and how we access and utilize the most efficient and sustainable modes of mobility for each specific distance. For short-distance movement of people and goods, in particular.

It is high time - not to say long overdue - to broaden our perception of the Concept of Mobility to also include technologies, products and services which offer us an even greater freedom to move than the privately owned cars can do.

Yes - we will need passenger cars also in the future. But we urgently need to stop considering the car as our primary option for mobility. Especially when traveling alone, light and for short distances.

Mobility also needs to become more flexible, accessible and easy-to-use.

Last but not least - mobility needs to be available to everyone.

Are you still skeptical about leaving your car at home and taking your eBike or eCargo Bike for your shorter rides?

Think again!

Micromobility is rapidly gaining favor worldwide - both among riders and decision makers.

We truly believe that short-distance movement of people and goods - which represents the most frequent and largest share of our demand for mobility - will become synonymous with Micromobility within the next 5-7 years.

That is why we are investing in Micromobility!

Let’s meet and discuss how we can take part, contribute, and reap the benefits of this exciting mobility transformation.

Don’t hesitate to contact us - we are here to support you!

Let's catch the Best Rides - together!

Micromobility is on the Rise!

By Anders Hedgren, Senior Adviser

McKinsey & Company conducts an annual consumer survey on transportation habits. Many respondents in the latest survey (2022) said that they are open to shifting their mobility habits:

• Almost one-third of respondents (30 percent) said that they plan to increase their use of #micromobility (for instance, eBikes and eScooters) or shared mobility over the next decade.

• Nearly one-half of respondents (46 percent) said that they are open to replacing their private vehicles with other modes of transport in the coming decade.

• Most respondents (70 percent) said that they are willing to use a shared autonomous shuttle with up to three other travelers; 42 percent of those trips would otherwise be taken by private vehicle.

This is great news - for our environment, health and urban mobility.

According to McKinsey, the desire for a more enjoyable mobility experience is behind many of these shifts.

According to McKinsey, again, the global micromobility market is worth around 180 billion USD today. By 2030 - only 7 years from now - McKinsey estimates it to be worth about 440 billion USD.

This is also great news - especially for those of us who want to take active part as investors in sustainable mobility.

We are all in for a more enjoyable mobility experience - both as riders and as investors!

Don’t hesitate to contact us - we are here to support you!

Let's catch the Best Rides - together!

The European Bicycle Market looks bright – but will require substantial investments

By Anders Hedgren, Senior Adviser

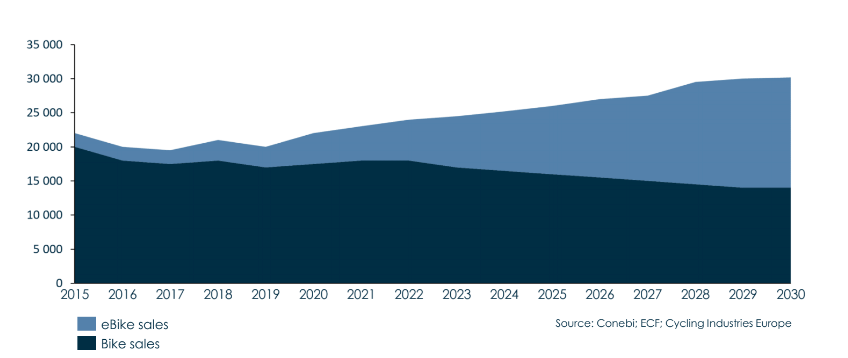

European Bicycle Sales Projection - Thousand Units

Looking

at the Macro Perspective

The need for investments in the European Bicycle Market is huge – and there are, of course, several reasons “WHY”.

Approaching the subject from the positive side, let me just refer us back to the 2030 forecast for the European Bicycle Market released in December 2020 by CIE, CONEBI and ECF.

Many of you have already seen this forecast. The projected growth is just amazing!

And growth like the one projected in the forecast above is one – but only one out of several important – parameters that investors are looking for.

When me and my colleagues in our MicroMobility Team put the forecast into context and look at the cumulative effects the projected growth will have on the Bicycle Supply and Distribution Chain, end-to-end, the future looks very promising. No doubt about that.

Having said that, and as both you and I are aware, the projected growth will not be realized without substantial investments. And a major industry transformation if you ask me.

The Bicycle Industry is and will continue to be unable to meet this rapid and huge increase in the demand for bicycles and bicycling related products and services unless decisive actions are taken - now.

The growth projected will require investments – not only in new products but also in production-, distribution-, retailing- and aftermarket services capabilities.

Furthermore, the growth projected will require a supply chain transformation – increasing capacities and, even more importantly, shortening of lead times by near shoring production, warehousing and OEM as well as online/offline retail distribution services.

And, the growth will also require business model innovation – with much more focus on our customers – why not Riders – convenience, accessibility and flexibility.

Hence, there is not only need for continuous investments in new technologies, components and products.

Yes its true. When others focus on aerodynamics, weight and speed I tend to focus more on what works – and what’s not working – from a strategic, commercial and financial point of view.

As with most market transformations driven by the introduction of new – or the commercial break-through of already existing technologies like the eBike – significant changes in demand, usage and/or shift in buying patterns, the opportunities are immense.

There are, however, also risks associated with both action and inaction.

This is “WHY” we have formed our MicroMobility team. A team of experienced and dedicated industry and investment banking experts who are investing substantial resources to assist with end-to-end strategic and financial advice within these investment areas.

And there is great support to be found right now – both from governments and public funding initiatives and from private investors – who are willing to invest in the Green Deal and our Future Active Mobility.

I’m so happy that I decided to take an active role in the Bicycle Industry some 13+ years ago. It took a bit longer than I hoped back then – but now it is actually happening.

Me and my colleagues in the MicroMobility Team are looking forward to supporting this and be active in this “Movement”.

Don’t hesitate to contact us. We are here to assist you!

“What’s

your take on innovation within the Bicycle Industry?”

By Anders Hedgren, Senior Adviser

I have been asked this question many times over the years.

And the question is, of course, highly relevant.

It was relevant the first time I was asked, walking up and down the aisles of Eurobike in Friedrichshafen. And it is even more relevant now, when preparing to meet both incumbents and new industry stakeholders and investors. Also at new venues like at the International Motor Show (IAA) in September 2021.

Innovation is “the Engine” in every society, industry and market.

Focusing for a second on product innovation and if asked – especially at venues like Eurobike or at some fantastic Dealer Event hosted by the OEMs every year – many of us would say that there is nothing wrong with the “level of innovation” within the Bicycle Industry.

And this is (party) true.

The Bicycle Industry do have a constant supply of new products which it brings to the market.

As a matter of fact, we tend to see to many companies being active within the same/similar product segment and field of innovation. Within areas where the Industry already meet – or even over-deliver – compared to market demand.

And this is, of course, neither efficient nor sustainable!

Before we say “check” and leave product innovation “as is” it is my honest opinion that we as an industry need to become more “user focused and demand driven”.

We are still much to focused on what we want to sell. We need to become less “supply driven” and listen more to what our customers – the end-users – want. The new customers and the younger generations, in particular. Those who take up cycling now. Perhaps for a different reason than we – the already “religious cyclists” – once did.

Our future depends on it.

We also need to engage ourselves much more in business innovation.

We urgently need to update our present value propositions, which are still focused on products and price, while our customers are demanding convenience – accessibility and flexibility – and, above all, experience in exchange for the trust and loyalty they are prepared to offer our brands in return.

And, as I have touched upon in a separate note on the rapidly growing Bicycle Market, we need to become much more innovative in our go-to-market strategies.

It is a clear sign of the time that companies like CANYON, being the north star of direct-to-consumer bicycle retailing, is receiving such an interest among investors.

There are several more of these good examples. Just look at the expansion and growth of Swapfiets who rightfully says “we don’t sell bikes” in its recently released celebration of its highly appreciated “subscription service”.

And, speaking of subscription services, two of the most attractive bicycling related businesses among investors right now are Zwift and Strava. Both focusing on the cyclists’ experience.

Yes its true. As I have admitted several times. When other Bicycle Industry experts focus on aerodynamics, weight and speed I tend to focus more on what we as an Industry need from a strategic, commercial and financial point of view.

And, of course, we will always have a demand for product innovation.

In short, my take on innovation is that we, as an industry, need to have a more

HOLISTIC – SUSTAINABLE – DEMAND DRIVEN approach to INNOVATION